August 20, 2010 PSW Staff |

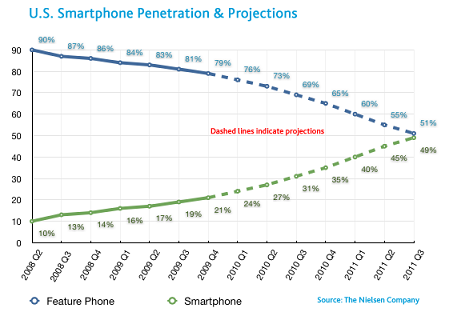

from the likes of Jim Cramer, Motley Fool and others. The company had beat EPS estimates during the previous quarter by 5 cents, or 45.5%. Even after estimates for the the most recent quarter were revised upward, RFMD managed to win again, this time around by 1cent. Of particular interest to most has been their ability to increase cash flow, retire debt and expand their market opportunities. As good as the last few quarters have been, which we will get to later, what is even better is the outlook for this company's products in the coming years. Once dubbed the father of the mobile Internet, RFMD sells a wide range of Radio Frequency components and semiconductor technologies that enable advanced functions in cell phones and wireless and wired data transfer. The company's most meaningful revenues come from products that go into cell phones, and more increasingly, smartphones. In 2009, 60% of the worlds population owned a cell phone, and only 17% of total global shipments in that year were smartphones. This percentage is rising fast, however, and many expect smartphone ownership to reach as high as one billion people in 2013. Smart phones have been penetrating the U.S. market even faster. The Nielson Company expects that by Christmas of 2011, one in two Americans will own a smartphone. RF Micro Devices has one little monkey on their back, however, or maybe it's an 800 pound gorilla. Their biggest customer by far is Nokia (NOK), and with the popularity of the Apple's (AAPL) iPhone and Research in Motion's (RIMM) Blackberry over the past couple of years, you may have even forgot they existed. Nevertheless, Nokia remains the biggest maker of cell phones in the world, but U.S. Sales are slumping, and the iPhone is catching up fast. Another major problem for RFMD centers around Nokia's inability to come out with a product that can compete. In May, Nokia appointed Anssi Vanjoki, a 20 year veteran of the Finland based company, to head their smartphone division. It remains to be seen how more of the same will work out for Nokia, especially through the eyes of investors. They reportedly have a new touchscreen smartphone called the N8 slated to ship by October. The phone includes a 12 megapixel camera, and is built around the newly open sourced Symbian Operating System. The price tag for the device is quite high at $750, but they will also be releasing a full line of smartphones with similar functionality below the N8 at the same time. So with all of Nokia's problems, why is RFMD still doing so well? Perhaps for two reasons. The first is that their products aren't just in smartphones, but also in regular phones, especially ones with more advanced features. Nokia still sells plenty of phones and has plenty of growth overseas, not to metion RFMD's substantial sales from a diverse range of other products. The second reason is that they have started seeking out and finding new markets and trying to bring their huge percentage of sales to Nokia down. RFMD has been ahead of the curve with technology, part of the reason their profit margins are slightly lower than their peers, but Nokia has been behind it in terms of innovation and marketing. Sales to Nokia in the the most recent quarter were 44% of RFMD's total revenue compared to 59% during the comparable quarter of 2009. Investors still seem a bit apprehensive at this point judging by some low valuations. Perhaps it is because the stock has already been through the wringer, finding a low under $1 in 2008. The company has seen five consecutive quarters of earnings growth since then, but perhaps it's the slightly slower pace of revenue growth that has them taking pause. The discrepancy is from successful cost cutting initiatives keeping cost of revenue down and selling, general and administrative expenses way down. Folks need to see more proof that the earnings growth is sustainable. The revenue increases have been substantial, however, and they are expected to stay at the current level and then rise even further at the end of this year. There are plenty of low valuations to point out, but the number that basically says it all is the forward P/E of 6. Keep in mind that the company has beat estimates every quarter for over a year now. All of this growth has left RFMD with very substantial cash flow, and they have been paying off a lot of debt, buying back some shares, and expanding their markets. In fact, the company announced an additional huge advance payment of $100 million on notes due in 2012 and another $10 million to pay of 100% of the 2010 notes, all of which was not even included in the most recent 10Q. Everything has been paid with cash on hand with no dilution to the current 273 million shares outstanding has been announced, except for a small amount of employee stock options. Also not included in the 10Q are results of a recent announcement that they have commenced high volume production shipments to leading smartphone manufacturers in Korea and China. With the rate this company has been paying off debt and adding new customers, they could indeed become a cash cow within the next year. The stock has been trading back and forth between 4 and 6 dollars for over a year now, and currently sits near the low end of that range. Shares held short in this stock were significantly less at the end of July than at the end of June, but are still at about 6%. Several other Semiconductor issues have experienced the same odd cycle of increasing profits, lower valuations and a fair amount of short interest over the past year. Is the low valuation due to the decline seen on the exuberance meter for technology over the past decade? Has tech gone from the 'pets.com' level to something as boring as utility stocks? Perhaps RFMD doesn't need a big story or a lot of excitement to go higher from here. Maybe they just need to keep plugging along and doing exactly what they're doing. |

| ©2010 Penny Stocks Weekly - Home - PSD 10 - Terms - A Message From The SEC - Important Information On Penny Stocks |

Analysis of listed, fully reporting penny stocks |

|

Full article access includes Buy, Sell & Stop-Loss conditions along with a no nonsense trading strategy. Don't jump in blind, subscribers also get a detailed risk analysis, portfolio. Get started for free right now with our weekly newsletter. |